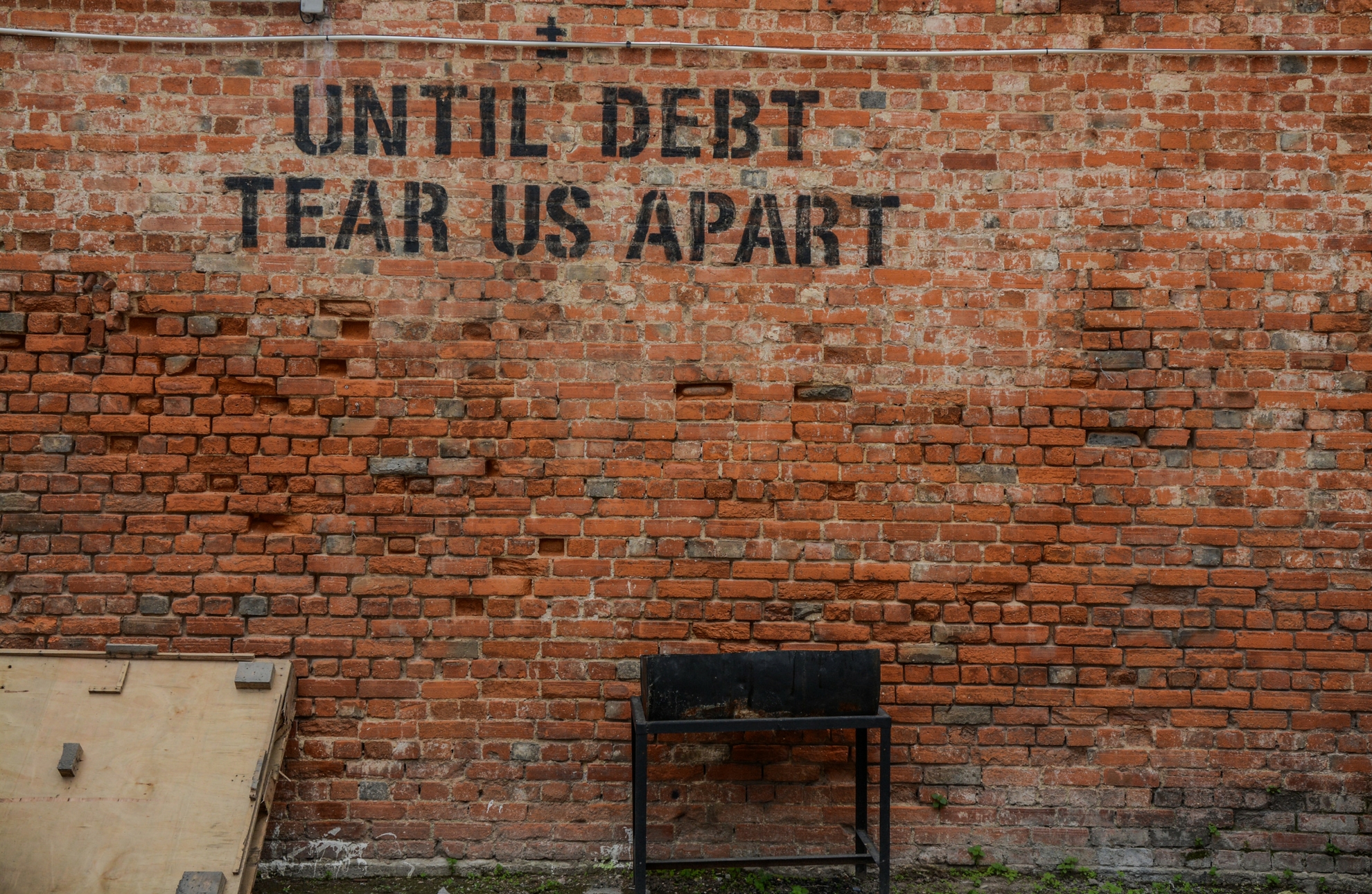

What are your financial priorities? That was a question hubby asked when we first became an item and joined our finances. You see, I was financially crippled right before meeting hubby. I lost everything that I had built.

What are your financial priorities? That was a question hubby asked when we first became an item and joined our finances. You see, I was financially crippled right before meeting hubby. I lost everything that I had built.

It took me years to recover my losses and to reap the rewards, which now allowed me to share my tribulations and triumphs.

Without going into too many details, I went through some life-changing events when I first met hubby from going through a divorce to unemployment while battling lawsuits at the same time. I didn’t even have a place to call home. Although I had financial goals at the time I felt like everything was crushed and seemed unattainable. I almost gave up.

Meeting hubby changed everything!

Fast forward ten years since then and I am now in the best financial position I have ever been. With hubby’s help (he turned out to be a financial geek!), we have no debt, low mortgage, few rental income, healthy emergency funds, solid retirement, and college funds set aside for our twins. On top of that, we had increased our real net worth (does not include cars, jewelry, and luxury goods) five times since we met.

It hasn’t been easy to get to where we are. We have made a lot of sacrifices and gave up a lot of fine dining and exotic vacations (stick with me…it’s not that bad to give up luxuries when you need to..know your priorities).

Throughout the next 11 months, I will be sharing our strategies to get to where we are. To kick start this series, the first step is to set your financial priorities.

Everyone has different financial priorities. Some people prefer to pay down their debt ( like student loans or credit cards ) first instead of saving for retirement or emergency. Other people prefer to do all these or not by just living in the moment from paycheck to paycheck. Sometimes, it’s not by choice but because of circumstances. The important thing is to know what you really want in life.

Our financial priorities at the time were clearing out my debt, saved for retirement and emergency.

To get to the right financial path and goals, we started our financial journey by setting a 50/40/10 rule where up to 50% of our take-home pay spent on essential expenses, like housing, transportation, utilities, and groceries. Nothing else. 40% of our take-home pay went to financial priorities like debt payments, retirement contributions, savings and emergency contributions. The other 10% of our take-home pay went toward our lifestyle choices like entertainment, personal care, and cell phone.

Throughout the years our priorities changed and the rule shifted from 50/40/10 to 50/30/20. We are now operating at the 40/30/30 rule based on our goals and financial priorities.

It is always good to re-examine your goals periodically. We used to look at our balance sheets every week but now it occurs once a month. And of course, whenever you’ve completed one, you can bring another to the forefront. But the important thing is to know where you want to go financially so that you can move forward with every financial planning decision, which I will share in an upcoming post.

10 Comments

I put together a whole spreadsheet after our wedding to work on paying our debt off and so far it’s working, but it is tough, that’s for sure!!

Yes, it is very painful and tough..not easy at all. And at times it felt like eternity and couldn’t get to the finished line soon enough. But once that’s over everything seemed to work effortlessly!

I really love that rule. I am pretty terrible at budgeting. Like actually allocating fund to particular areas. I’m good at not going over board and keeping money in check but I always have those moments right before my bank account loads and I’m cringing because I’m afraid to see what I’ve spent lol

We don’t call it budget because it sounds too constrained and unmotivated. We just know what our priorities are and stick with how we want our financial life to work. I will be sharing those strategies very soon!

Two of my new years resolutions are getting out of debt and dropping some weight. Both are slow processes, but once you start seeing results it is all worth it.

Yep, I agree! Good luck and wish you success!!!

That is a way to divide your income. It’s a good thing your husband was a financial geek.

I’m so blessed to have him in my life!

Thank you so much for sharing your story and for giving us an overview on how to overcome financial problems! So good that your hobby helps you with all this financial stuff!

It wasn’t easy but we (especially me) learned so much about each other. This process brought us closer as a couple and also has helped us in raising our kids in a happy household.